south st paul mn sales tax rate

125 lower than the maximum sales tax in MN. The latest sales tax rate for Saint Paul MN.

Minnesota Maple Syrup Orchards And Sugarworks Find A Local Maple Syrup Farm Near You In Minnesota To Buy Local Maple Syrup Even See It Being Made

While many other states allow counties and other localities to collect a local option sales tax.

. Homes similar to 241 South St E are listed between 230K to 599K at an average of 185 per square foot. How does the Saint Paul. The minimum combined 2022 sales tax rate for South St Paul Minnesota is.

010 - 050 New Employers. Sales Tax Rate Calculator. This includes the rates on the state county city and special levels.

Ad Get Minnesota Tax Rate By Zip. 144 or 834 Employers with Experience Rating. What is the sales tax rate in South St Paul Minnesota.

The Saint Paul Minnesota sales tax is 688 the same as the Minnesota state sales tax. The 7875 sales tax rate in Saint Paul consists of 6875 Minnesota state sales tax 05 Saint Paul tax and 05 Special tax. This is the total of state county and city sales tax rates.

Up to 890. 112 E Warburton St South Saint Paul MN. This rate includes any state county city and local sales taxes.

Free Unlimited Searches Try Now. The 7125 sales tax rate in South Saint Paul consists of 6875 Minnesota state sales tax and 025 Special tax. Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

On January 1 2000 the 050 local option sales and use tax was implemented within the City of Saint Paul to fund the Sales Tax Revitalization STAR program. 2020 rates included for use while preparing your income tax. 9800 of gross income.

There is no applicable. South Saint Paul is located within Dakota. See reviews photos directions phone numbers and more for Sales Tax Rate locations in South Saint Paul MN.

The south st paul sales tax rate is. 05 lower than the maximum sales tax in MN. The 7125 sales tax rate in South Saint Paul consists of 6875 Minnesota state sales tax and 025 Special tax.

Sales. The average cumulative sales tax rate in South Saint Paul Minnesota is 713. The results do not include special local taxessuch as admissions entertainment liquor.

Little Known Tax Advantage Benefits Minnesota Businesses Finance Commerce

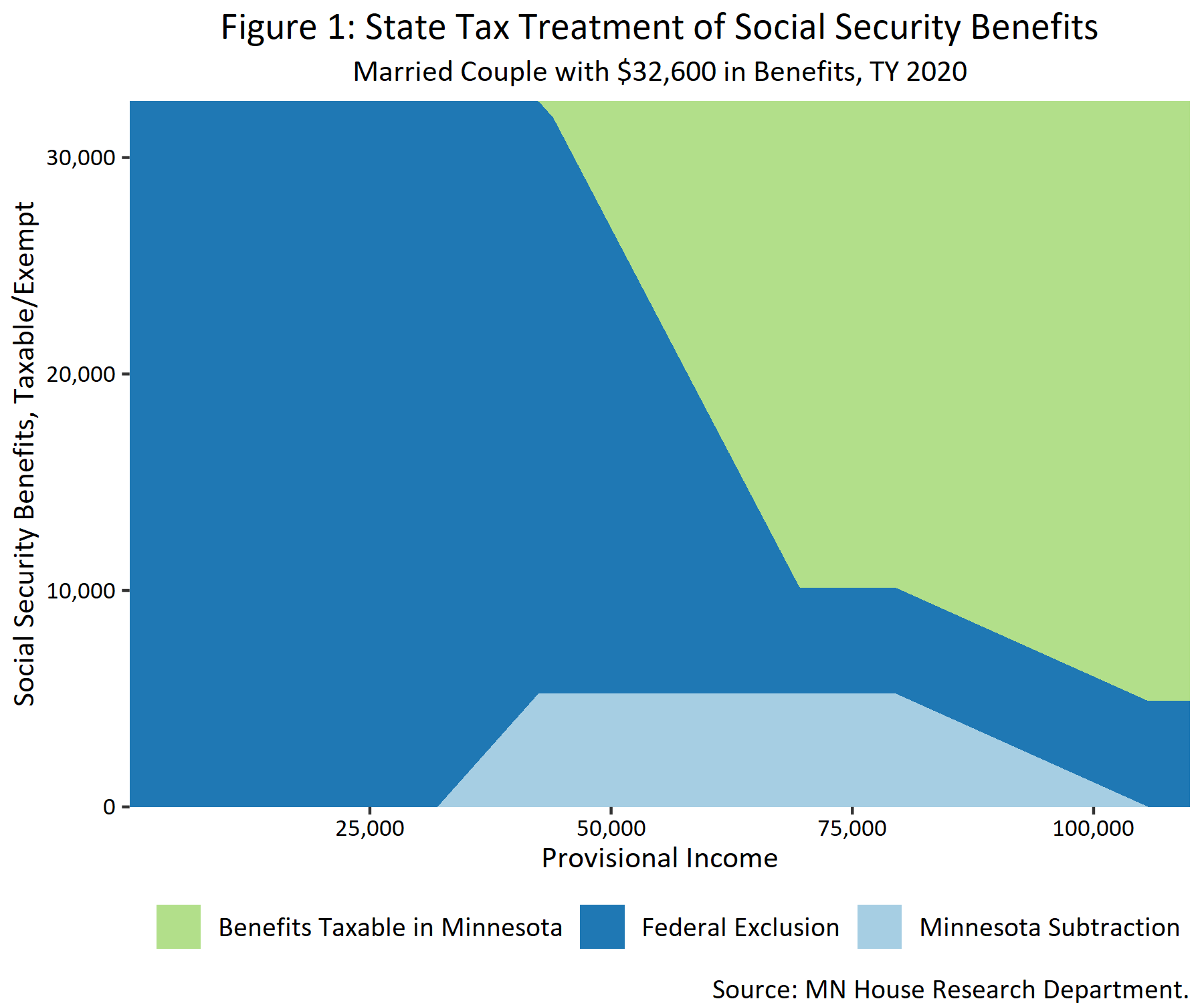

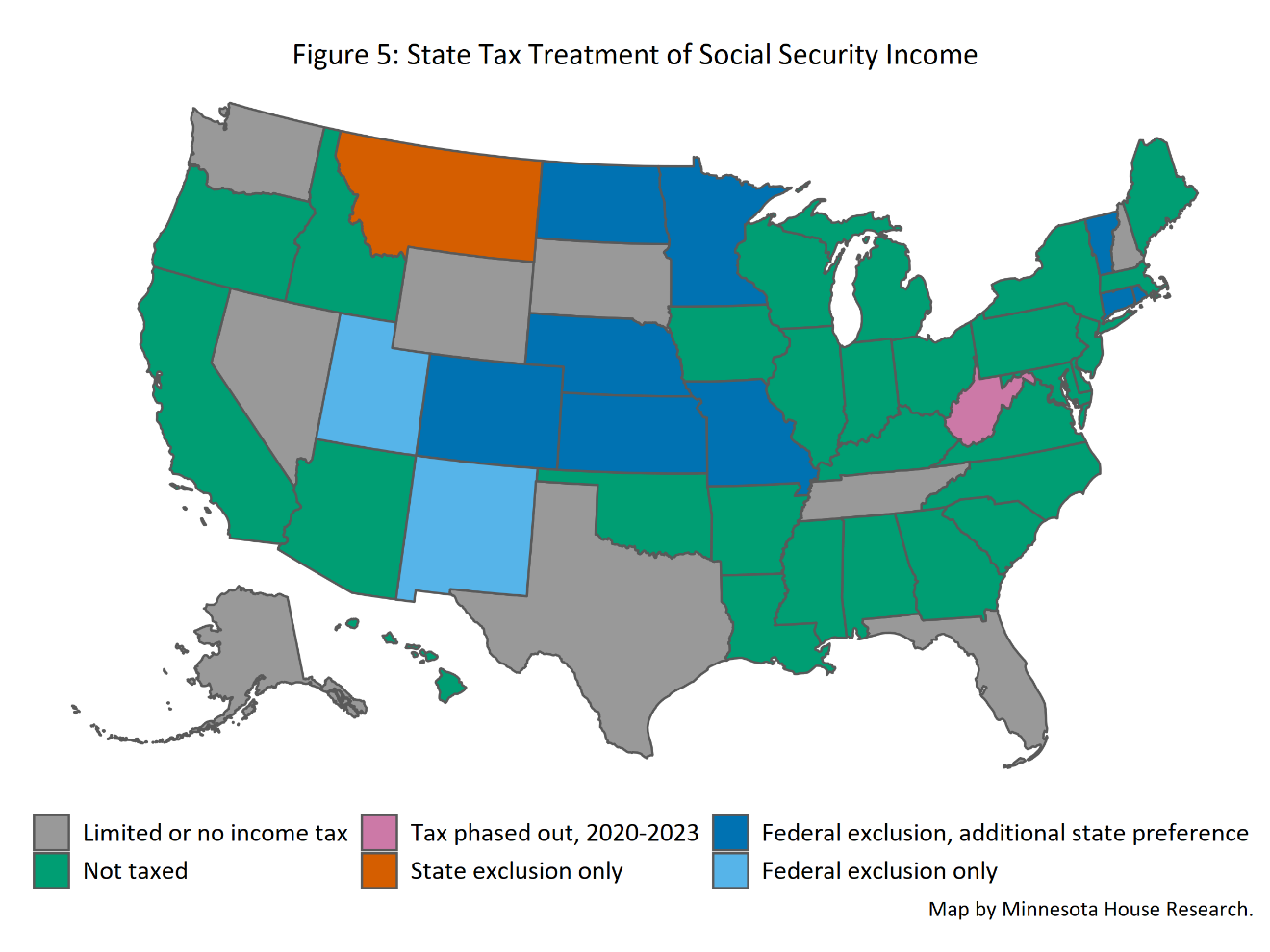

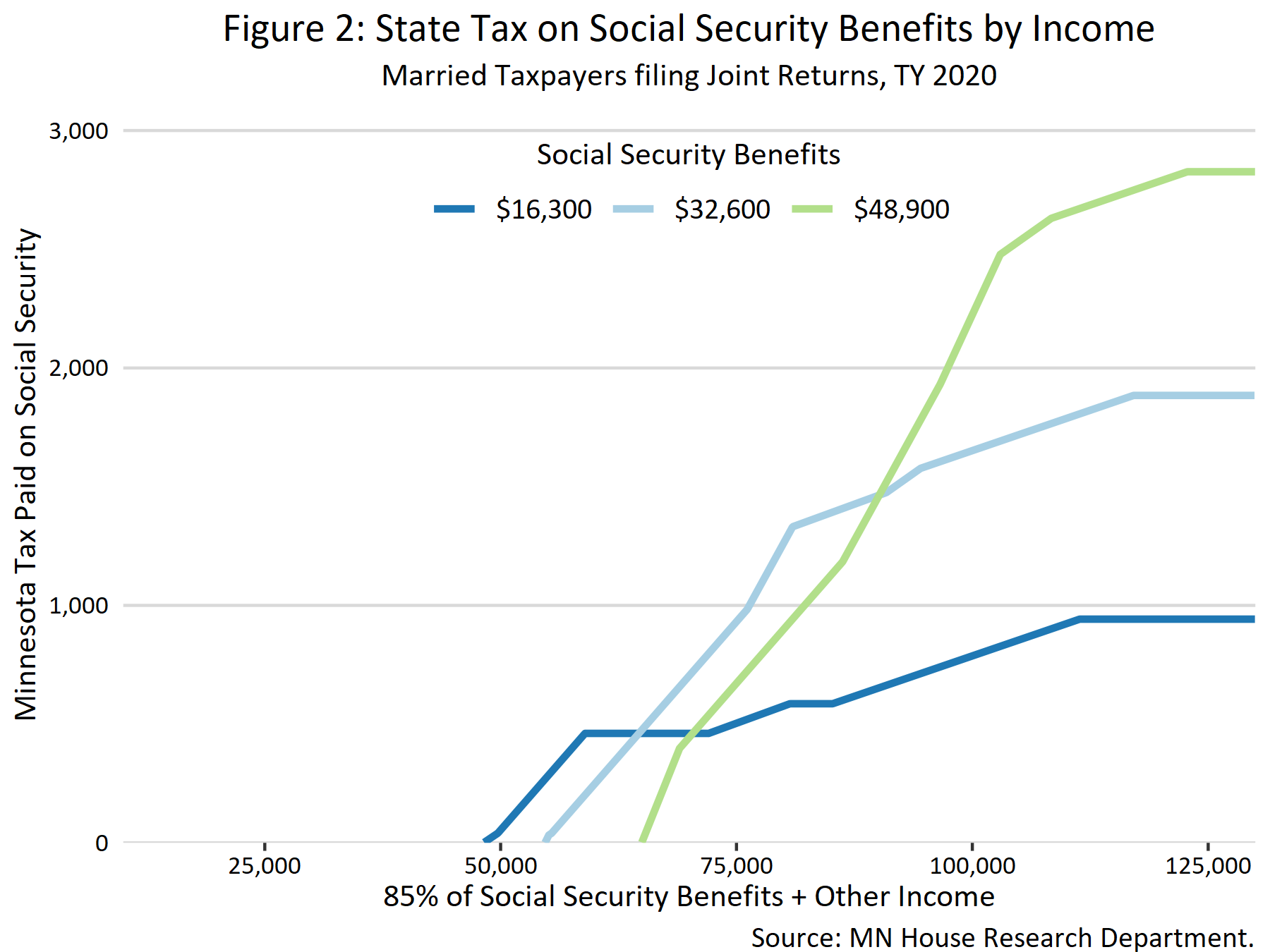

Taxation Of Social Security Benefits Mn House Research

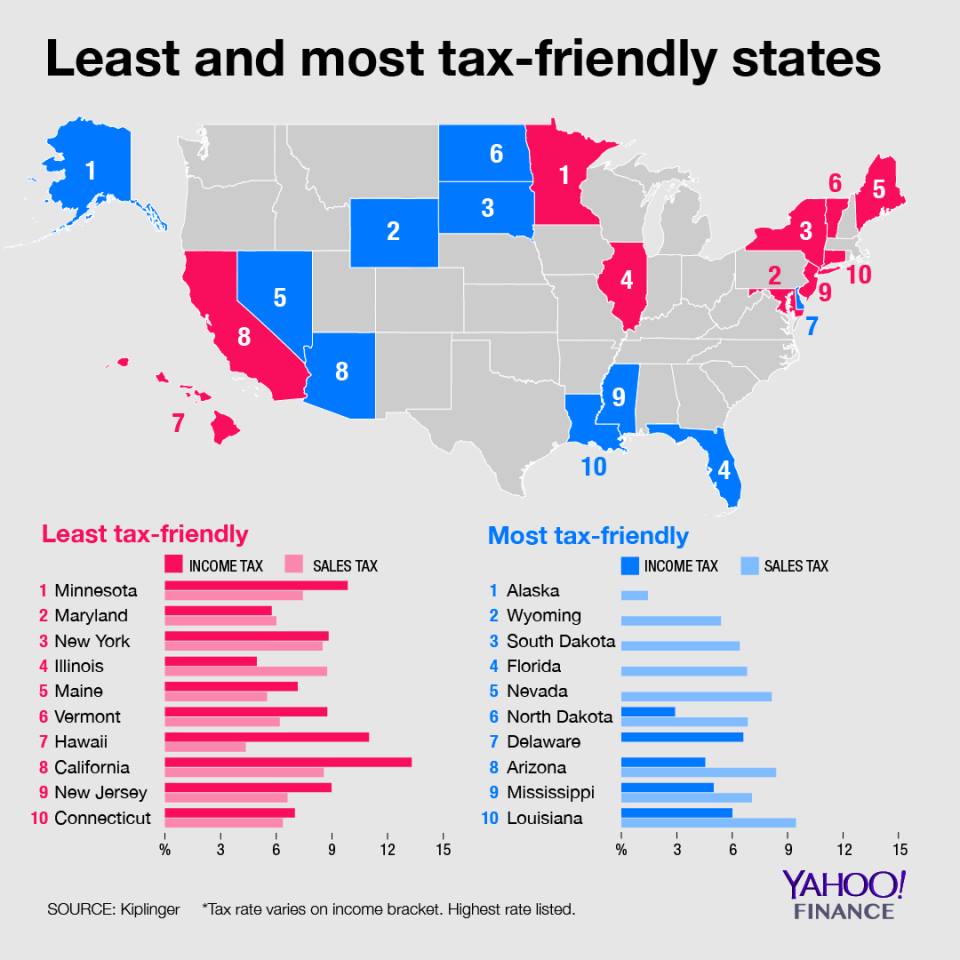

State And Local Sales Tax Rates Sales Taxes Tax Foundation

It Isn T Minnesota S High Taxes That Make It A Great Place To Live Or Get Educated American Experiment

Historical Tennessee Tax Policy Information Ballotpedia

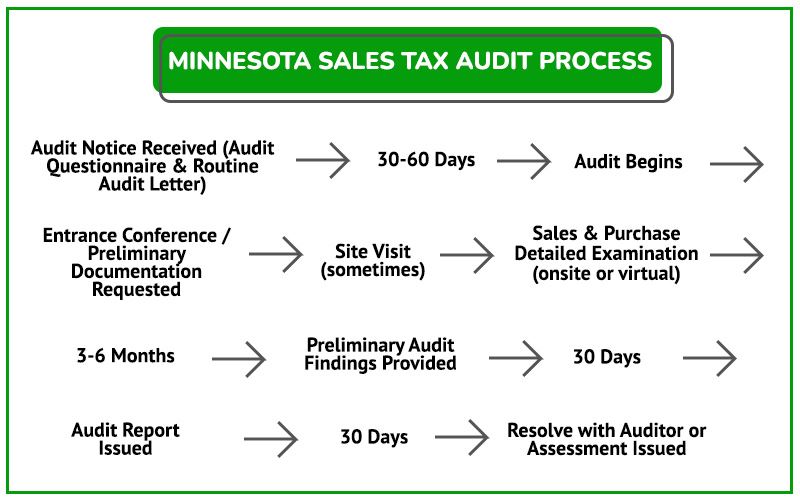

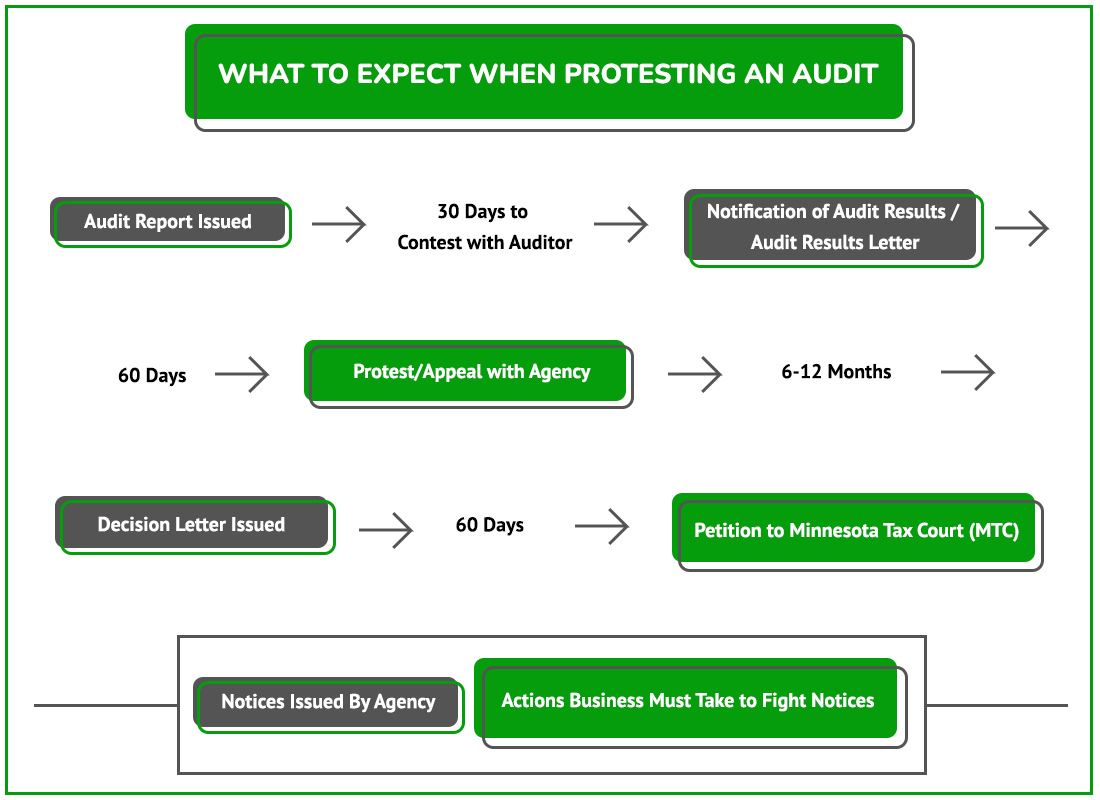

Minnesota Sales Tax Guide For Businesses

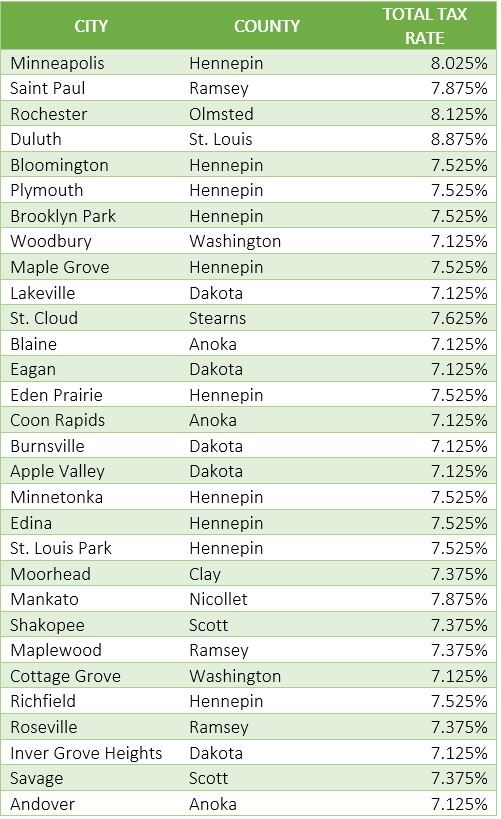

Minnesota Sales Tax Rates By City County 2022

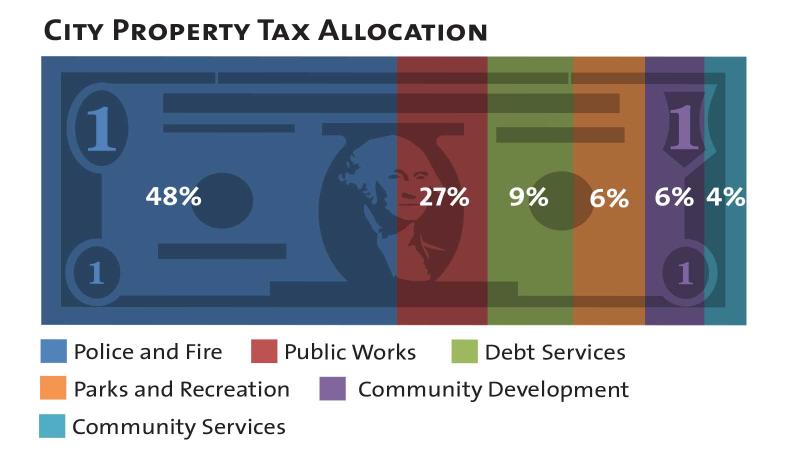

Council Approves 2022 Tax Levy City Of Bloomington Mn

Minnesota Has The Highest Car Rental Taxes In America American Experiment

Taxation Of Social Security Benefits Mn House Research

Minnesota Sales Tax Guide For Businesses

If Doctors Chose Their Job Locations Based On State Income Taxes White Coat Investor

Taxation Of Social Security Benefits Mn House Research

State And Local Sales Tax Rates Sales Taxes Tax Foundation